Rent to rent is a strategy that has gained traction in the UK property market, particularly in cities where housing demand remains high. It involves renting a property from a landlord, often for a fixed price, and then subletting it to tenants, typically on a room-by-room basis or as a whole. While rent to rent offers some appealing advantages, it also comes with challenges that potential investors should be aware of. Let’s explore the key ups and downs of the rent to rent model in the UK.

The Ups of Rent to Rent

1. Low Entry Cost

One of the most attractive aspects of rent to rent is the relatively low cost of entry. Unlike traditional property investment, which often requires significant capital for deposits, mortgages, and refurbishments, rent to rent allows investors to control properties without purchasing them. You only need enough funds to cover the first month’s rent, deposit, and any minor renovations.

2. Cash Flow Potential

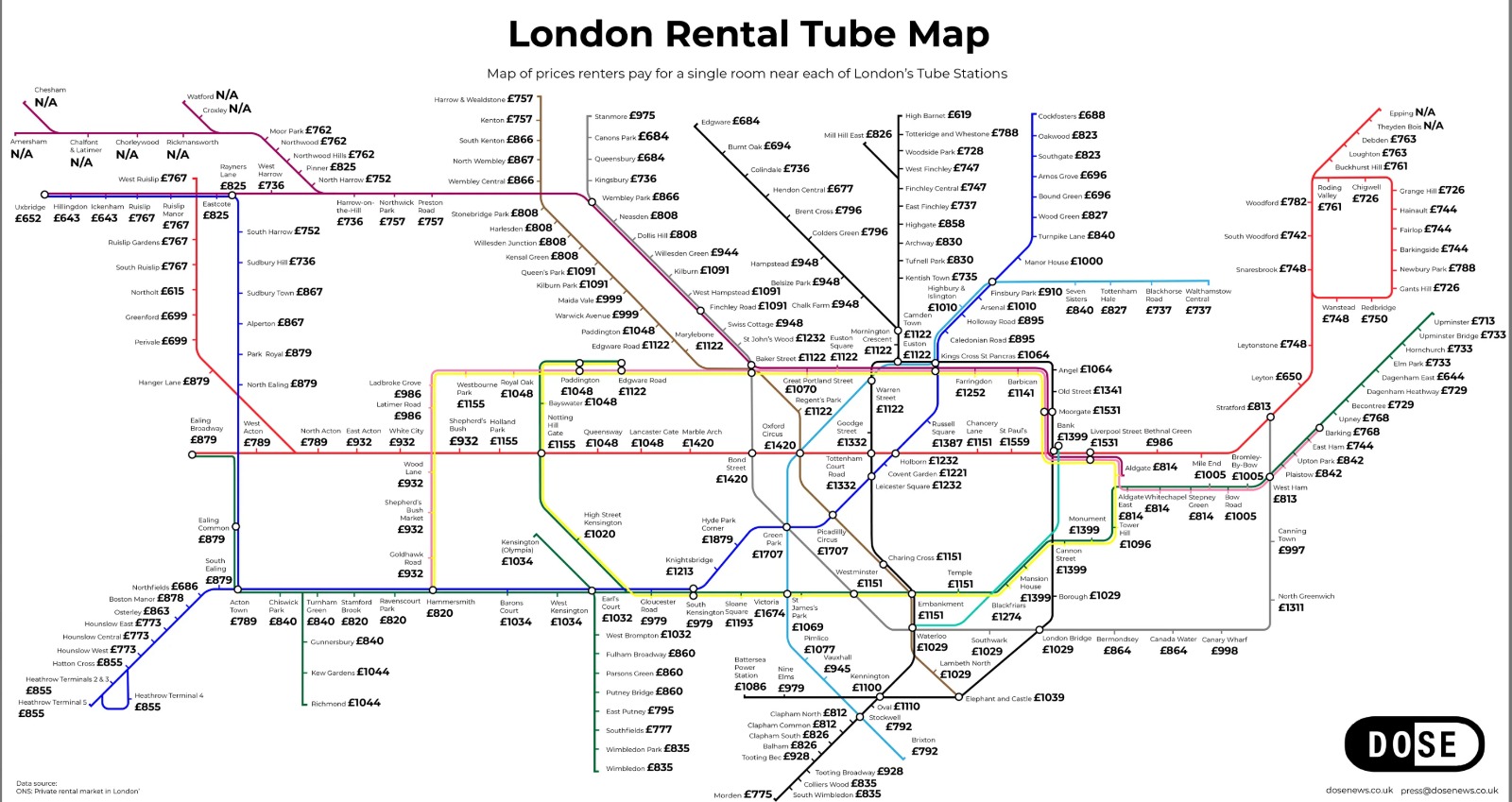

Rent to rent can provide impressive cash flow if done correctly. By securing properties in high-demand areas and renting them out to tenants at a higher combined price than the initial rent, rent to renters can earn the difference as profit. This works particularly well in areas where the rental demand is strong, such as cities like London, Manchester, and Birmingham.

3. Flexible Business Model

Rent to rent offers flexibility in terms of scaling the business. You can manage multiple properties without being tied to long-term ownership, allowing for faster expansion. It also provides a short-term option to exit the arrangement if market conditions change or if a specific property becomes less profitable.

4. Helps Landlords with Void Periods

Many landlords are attracted to the rent to rent model because it guarantees consistent income, even during periods when the property might otherwise be vacant. Rent to renters often take on the responsibility of finding tenants, maintaining the property, and ensuring rent is paid regularly, reducing stress for the landlord.

The Downs of Rent to Rent

1. Legal Complexities

One of the biggest challenges with rent to rent is navigating the legal aspects. Subletting can be tricky, and agreements must be watertight to avoid issues. You must ensure that you have the proper consent from the landlord and that the mortgage lender or freeholder does not prohibit subletting. Failure to comply with legal requirements can lead to breaches of contract and hefty fines.

2. Void Periods and Unpaid Rent

Just like landlords, rent to renters face the risk of void periods where rooms or the entire property remain unoccupied. If you have agreed to pay a fixed rent to the landlord, void periods can quickly erode your profits. Additionally, tenants may fail to pay rent on time, leaving you with financial strain while still having to meet your rental obligations to the property owner.

3. Property Maintenance and Compliance

As a rent to renter, you take on responsibility for maintaining the property to a good standard. This includes repairs, safety checks (e.g., gas and electrical certificates), and ensuring the property complies with regulations such as HMO (Houses in Multiple Occupation) licensing, which can be costly. If major issues arise, your profit margins can shrink quickly.

4. Negative Public Perception

The rent to rent strategy has received some negative press in recent years, particularly due to cases where investors have poorly managed properties or misled landlords. This can lead to a damaged reputation for rent to renters, making it harder to secure new properties or tenants in the future. Transparency and professionalism are key to overcoming this challenge.

Ready for a Rent to Rent Adventure?

If you’re ready to take on the exciting adventure of rent to rent, but need expert guidance to get started, **Sholz Homes** is here to help. With our industry knowledge and experience in the UK market, we can support you in navigating the complexities, ensuring that your rent to rent journey is both profitable and compliant. Whether you’re a new investor or looking to scale your property business, Sholz Homes can provide the resources and strategies you need to succeed.

Conclusion

Rent to rent can be a lucrative strategy for those who understand the market, have a keen eye for finding the right properties, and are diligent about legal and maintenance obligations. However, like any investment, it comes with risks. Thorough due diligence, understanding of local rental demand, and careful management are crucial to success.

Whether you're a budding investor looking for cash flow without the commitment of property ownership or a landlord considering rent to rent for your property, it’s essential to weigh the pros and cons. With the right approach, rent to rent can work, and Sholz Homes is here to help you thrive in the ever-changing UK market. Reach out today to get started!

Info@sholzhomes.com

https://form.jotform.com/232512095539356