Introduction

Owning or renting a home in London often feels out of reach — but it doesn’t have to be. With data, patience, and strategy, affordable options exist. This guide explains what “affordable” really means in 2025, the best schemes to use, and the neighbourhoods where your money goes further. Finally, see how SholzHomes can make the entire process simpler for you.

Understanding Affordability in 2025

- Average London rent for typical flats is now over £2,200 per month.

- London Living Rent (LLR) caps rent at around £1,563/month in certain wards.

- Eligibility for LLR is now open to those earning up to £67,000/year.

- Shared Ownership has become easier — new rules allow buyers to start from just a 10% ownership share, reducing the initial cost.

How to Buy an Affordable Home

- Use Shared Ownership

Buy a smaller share (starting from 10%) and pay rent on the remainder. You can increase your ownership gradually as your finances improve. - Explore London Living Rent

Compare benchmark rents in your preferred area — in many boroughs, this is much cheaper than private rents. - Plan Your Budget Wisely

Include mortgage or rent, service charges, council tax, and transport. Aim to keep housing costs around 30–35% of your income. - Consider Outer Boroughs with Strong Transport Links

Areas like Bexley, Havering, Sutton, and Croydon offer better value while remaining connected by train, tube, or overground. - Be Smart About Property Type

Flats and older maisonettes often cost less than new builds, which may carry higher premiums and service fees.

How to Rent Affordably

- Try to keep rent within 30–35% of your income.

- Check London Living Rent and other affordable rent schemes.

- Outer boroughs such as Bexley, Havering, and Sutton offer 1-bed flats from around £1,480–£1,520/month.

- Have your references, credit record, and documents ready before applying.

Best Value Neighbourhoods (2025 Data)

Borough/Area: Bexley

Average Rent: ~£1,485/month

Highlights: Among the lowest in London; ideal if you don’t mind a longer commute.

Borough/Area: Havering

Average Rent: ~£1,522/month

Highlights: Rapidly developing with better amenities and transport.

Borough/Area: Sutton

Average Rent: ~£1,521/month

Highlights: Family-friendly, peaceful, and affordable.

Borough/Area: Croydon

Average Rent: ~£1,520–£1,550

Highlights: Excellent transport links and mixed property zones.

Other Boroughs: Barking, Lewisham, Enfield

Highlights: Offer more options but inspect properties carefully for safety and quality.

Rent vs Buy: Realistic Scenarios

Scenario: Rent – Outer London (Bexley)

Monthly Rent: £1,485

Estimated Monthly Mortgage: £1,700–£2,100

Difference: -£200 to -£600

Breakeven: 5–8 years

Scenario: Rent – Inner London (Kensington & Chelsea)

Monthly Rent: £3,600+

Estimated Monthly Mortgage: £4,500–£6,000+

Difference: -£800 to -£1,500

Breakeven: 10+ years

Considerations and Trade-offs

- Service charges and hidden fees can increase overall costs.

- Rent or mortgage rates may rise due to inflation.

- Longer commutes can offset housing savings.

- Some outer zones grow slower in property value — connectivity matters.

Visual Suggestions for the Blog

To make your article more engaging:

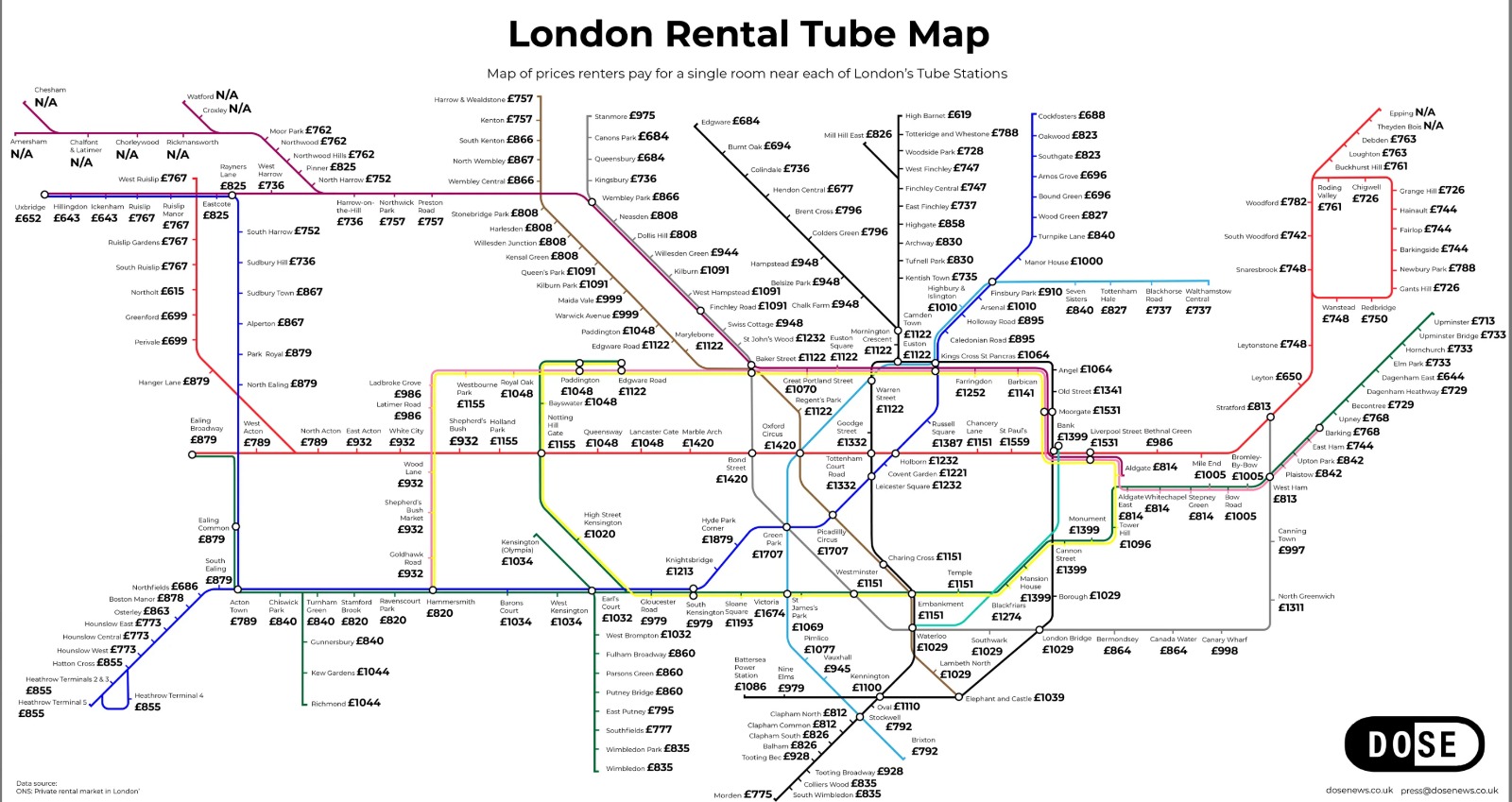

- A London borough heatmap showing rent levels.

- A transport zone map linking costs to distance.

- A graph comparing “Rent vs Buy” over 10 years.

- Property photos from outer and inner London.

Conclusion: How SholzHomes Can Help

Affordable living in London is possible — it’s about strategy, smart choices, and the right guidance.

At SholzHomes, we:

- Match you with listings in affordable, well-connected areas.

- Explain the full cost breakdown before you commit.

- Support you through Shared Ownership or London Living Rent processes.

Get in touch with your budget, preferred boroughs, and housing goals. Let us help you find a home that fits your lifestyle and finances.