📈 What’s Happening in the UK Housing Market Right Now

Despite a January rise in asking prices, the market is showing signs of balance. More homes are being listed — offering buyers more choice — and lenders have kept mortgage rates relatively stable, which can help with affordability.

Plus, house price-to-income ratios are becoming more manageable for first-time buyers – the lowest in over a decade in some areas. That means the dream of owning a home could be closer than you think.

🏘️ Top Tips for Finding Affordable Homes in the UK

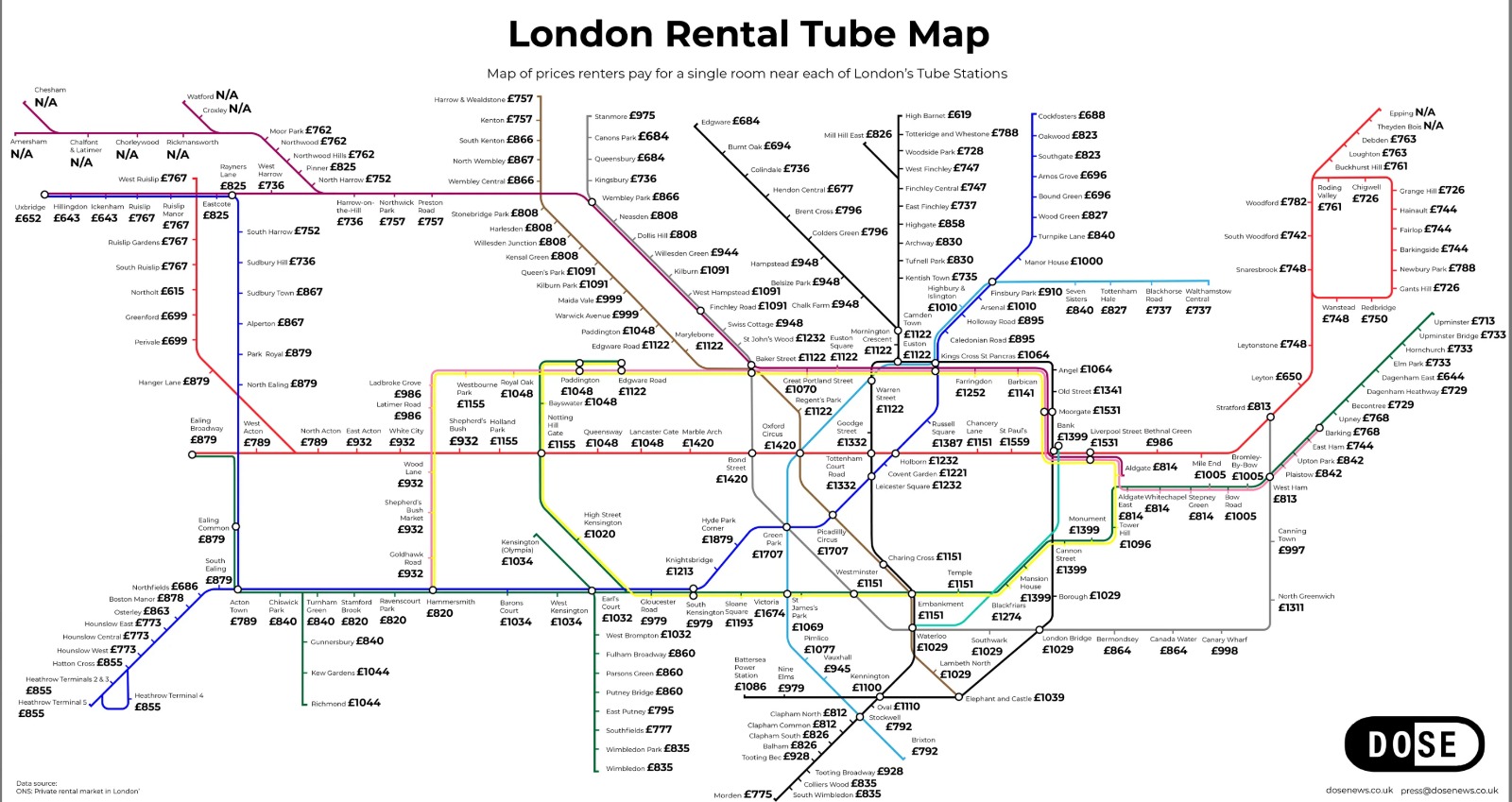

1. Expand Your Search Beyond London

Looking outside pricey city centres — to places like the North East, Yorkshire, or the Midlands — can reveal homes at a fraction of the cost. Some towns there regularly report average prices far below the national average.

2. Consider Properties That Need A Makeover

Homes that need some cosmetic work often list at lower prices. If you’re willing to put in a bit of effort or investment, you could secure a much better deal.

3. Explore Shared Ownership & Government Schemes

Programs like Shared Ownership or government-backed schemes help buyers get on the property ladder with a smaller deposit or shared equity — ideal for first-time buyers or those with tighter budgets.

4. Don’t Overlook Auctions

Property auctions can be a hidden gem for affordable homes, especially for buyers ready to move quickly and have funds lined up.

5. Prioritise What Matters Most

Before you browse listings, decide what you must have versus what you want. That focus keeps you from overspending on features you can live without.

🧠 Make the Market Work for You

Remember, more houses on the market means negotiation opportunities. With buyers coming back into the scene after year-end slowdowns, sellers may be more open to reasonable offers — especially on homes that have been listed for a while.

📍 Final Thought

While the UK housing market still poses challenges, 2026 presents real openings for buyers prepared to explore creatively and act decisively. Whether you’re buying alone, with a partner, or through a shared–ownership route, investing in the right home at the right price starts with smart research and informed decisions.